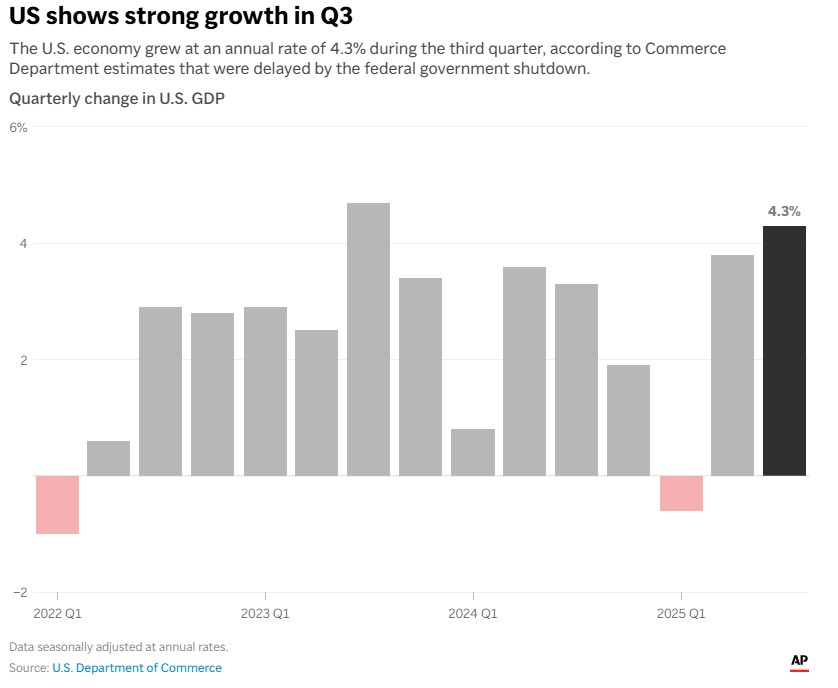

WASHINGTON — The U.S. economy grew at a surprisingly strong 4.3% annual rate in the third quarter, the most rapid expansion in two years, driven by consumers who continue to spend in the face of ongoing inflation.

U.S. gross domestic product from July through September — the economy’s total output of goods and services — rose from its 3.8% growth rate in the April-June quarter, the Commerce Department said Tuesday in a report delayed by the government shutdown. Economists surveyed by the data firm FactSet forecast growth of just 3% in the period.

As has been the case for most of this year, the consumer is providing the fuel that is powering the U.S. economy. Consumer spending, which accounts for about 70% of U.S. economic activity, rose to a 3.5% annual pace last quarter. That’s up from 2.5% in the April-June period.

A number of economists, however, believe the growth spurt may be short-lived with the extended government shutdown dragging on the economy in the fourth quarter, as well as a growing number of Americans fatigued by stubbornly high inflation.

A survey published by the Conference Board Tuesday showed that consumer confidence slumped close to levels not seen since the U.S. rolled out broad tariffs on its trading partners in April.

“The jump in consumer spending reminds me a lot of last year’s (fourth quarter),” said Stephen Stanley, chief U.S. economist at Santander. “Consumers were stretching. So, as was the case entering this year, households probably need to take a breather soon.”

However, at least in recent years, consumer spending has held up even when data suggests they’ve grown more anxious about money.

Tuesday’s GDP report also showed that inflation remains higher than the Federal Reserve would like. The Fed’s favored inflation gauge — called the personal consumption expenditures index, or PCE — climbed to a 2.8% annual pace last quarter, up from 2.1% in the second quarter.

Excluding volatile food and energy prices, so-called core PCE inflation was 2.9%, up from 2.6% in the April-June quarter.

Economists say that persistent and potentially worsening inflation could make a January interest rate cut from the Fed less likely, even as central bank official remain concerned about a slowing labor market.

“If the economy keeps producing at this level, then there isn’t as much need to worry about a slowing economy,” said Chris Zaccarelli, chief investment officer for Northlight Asset Management, adding that inflation could return as the greatest threat to the economy.

Another consistent driver in the U.S. economy, spending on artificial intelligence, was also evident in the latest data.

Investment in intellectual property, the category that covers AI, grew 5.4% in the third quarter, following an even bigger jump of 15% in the second quarter. That figure was 6.5% in the first quarter.

Consumption and investment by the government grew by 2.2% in the quarter after contracting 0.1% in the second quarter. The third quarter figure was boosted by increased expenditures at the state and local levels and federal government defense spending.

Private business investment fell 0.3%, led by declines in investment in housing and in nonresidential buildings such as offices and warehouses. However, that decline was much less than the 13.8% slide in the second quarter.

Within the GDP data, a category that measures the economy’s underlying strength grew at a 3% annual rate from July through September, up slightly from 2.9% in the second quarter. This category includes consumer spending and private investment, but excludes volatile items like exports, inventories and government spending.

Exports grew at an 8.8% rate, while imports, which subtract from GDP, fell another 4.7%.

Tuesday’s report is the first of three estimates the government will make of GDP growth for the third quarter of the year.

Outside of the first quarter, when the economy shrank for the first time in three years as companies rushed to import goods ahead of President Donald Trump’s tariff rollout, the U.S. economy has continued to expand at a healthy rate. That’s despite much higher borrowing rates the Fed imposed in 2022 and 2023 in its drive to curb the inflation that surged as the United States bounced back with unexpected strength from the brief but devastating COVID-19 recession of 2020.

Though inflation remains above the Fed’s 2% target, the central bank cut its benchmark lending rate three times in a row to close out 2025, mostly out of concern for a job market that has steadily lost momentum since spring.

Last week, the government reported that the U.S. economy gained a healthy 64,000 jobs in November but lost 105,000 in October. Notably, the unemployment rate rose to 4.6% last month, the highest since 2021.

The country’s labor market has been stuck in a “low hire, low fire” state, economists say, as businesses stand pat due to uncertainty over Trump’s tariffs and the lingering effects of elevated interest rates. Since March, job creation has fallen to an average 35,000 a month, compared to 71,000 in the year ended in March. Fed Chair Jerome Powell has said that he suspects those numbers will be revised even lower.