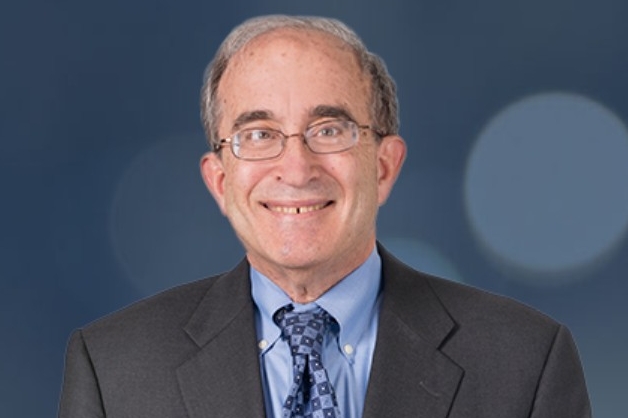

David M. Jordan, 91, formerly of Jenkintown, prolific author, eclectic historian, retired lawyer, former president of the Jenkintown Borough Council, veteran, and lifelong baseball fan, died Saturday, Jan. 24, of sepsis at Bryn Mawr Hospital.

Born in Philadelphia, Mr. Jordan grew up in Wyncote, Abington, and Huntingdon Valley in Montgomery County. He played high school baseball, graduated from William Penn Charter School, and earned his law degree at what is now the University of Pennsylvania’s Carey School of Law.

He was fanatical about the old Philadelphia Athletics baseball team that moved to Kansas City in 1954 and later, a bit reluctantly, followed the Phillies. He attended the Phillies’ last home game at long-gone Connie Mack Stadium in 1970, their first and last home games at long-gone Veterans Stadium in 1971 and 2003, and their first home game at Citizens Bank Park in 2004.

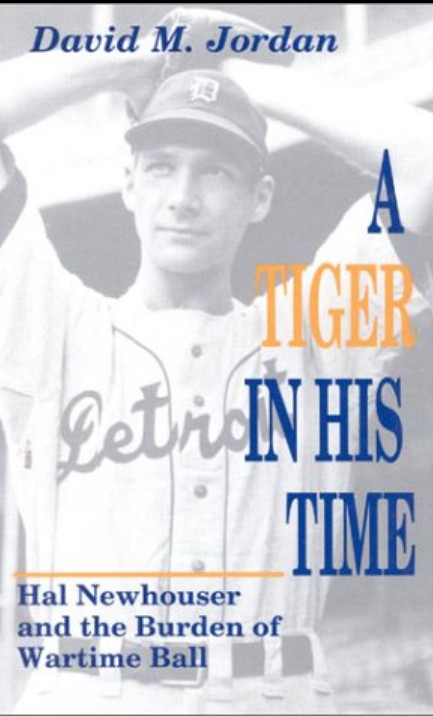

He shared his fascination with baseball by writing books about the Athletics and Phillies, iconic stadiums around the country, and star players Pete Rose and Hal Newhouser. Newhouser even credited Mr. Jordan’s 1990 book, A Tiger in His Time: Hal Newhouser and the Burden of Wartime Ball, with helping him get elected into the National Baseball Hall of Fame in 1992.

Writing “seemed to come naturally,” Mr. Jordan told the Princeton University Alumni Weekly in 2017. “I enjoy the creative part, to put my thoughts down on paper on a subject I have picked out for particular reasons.”

He wrote The Athletics of Philadelphia in 1999, and a reviewer for the Baseball Almanac said: “Jordan’s account is full of fascinating insights and interesting stories that make this fine franchise and those associated with it come alive.” He was interested in politics as well and built on his 1956 senior thesis research at Princeton by writing Roscoe Conkling of New York: Voice in the Senate in 1971.

The 477-page book was considered for a Pulitzer Prize, and a reviewer for the journal Pennsylvania History called it “readable and well-balanced” in a review. He said Mr. Jordan’s “treatment of Conkling is judicious, avoiding the pitfalls of hero worship or cynicism.”

He also wrote history books about Civil War generals Winfield Scott Hancock and Gouverneur K. Warren, former Secretary of Defense Robert A. Lovett, and the 1944 presidential election. In 1989, a book reviewer for The Inquirer called Mr. Jordan’s Winfield Scott Hancock: A Soldier’s Life “a complete life of Montgomery County’s greatest son, and it, too, is superb.”

“These people are sort of lost in history,” Mr. Jordan told The Inquirer in 2000. “But with people who are fairly well known, it’s hard to find something new to say about them.”

Mr. Jordan earned his law degree at Penn in 1959 and specialized in trust, estate, and municipal issues for 40 years in Philadelphia and later as a partner at Wisler Pearlstine in Montgomery County. He said in 2000 that he usually worked on his books every night after work from 7:30 to 10:30 p.m. and on weekends. “I don’t watch much television,” he said.

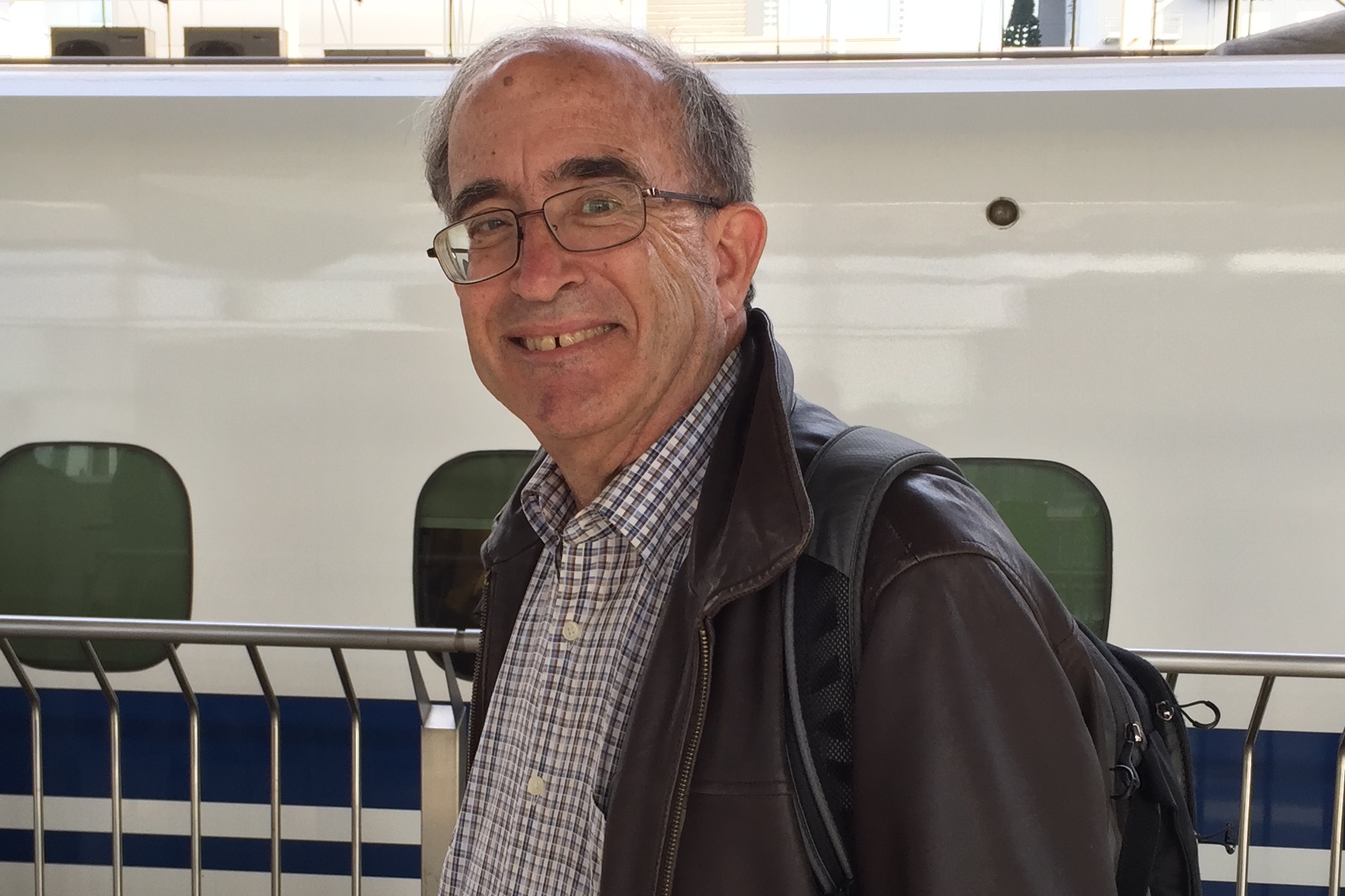

He traveled to New York, Missouri, California, and elsewhere to visit historical sites and research his subjects. He was a member of the Society for American Baseball Research and president of the Philadelphia Athletics Historical Society for 12 years in the 2000s.

He lectured often about baseball at symposiums and conventions, and was featured in The Inquirer and on podcasts. “He had a passion for knowledge,” his daughter Diana said. “He was a consumer of information.”

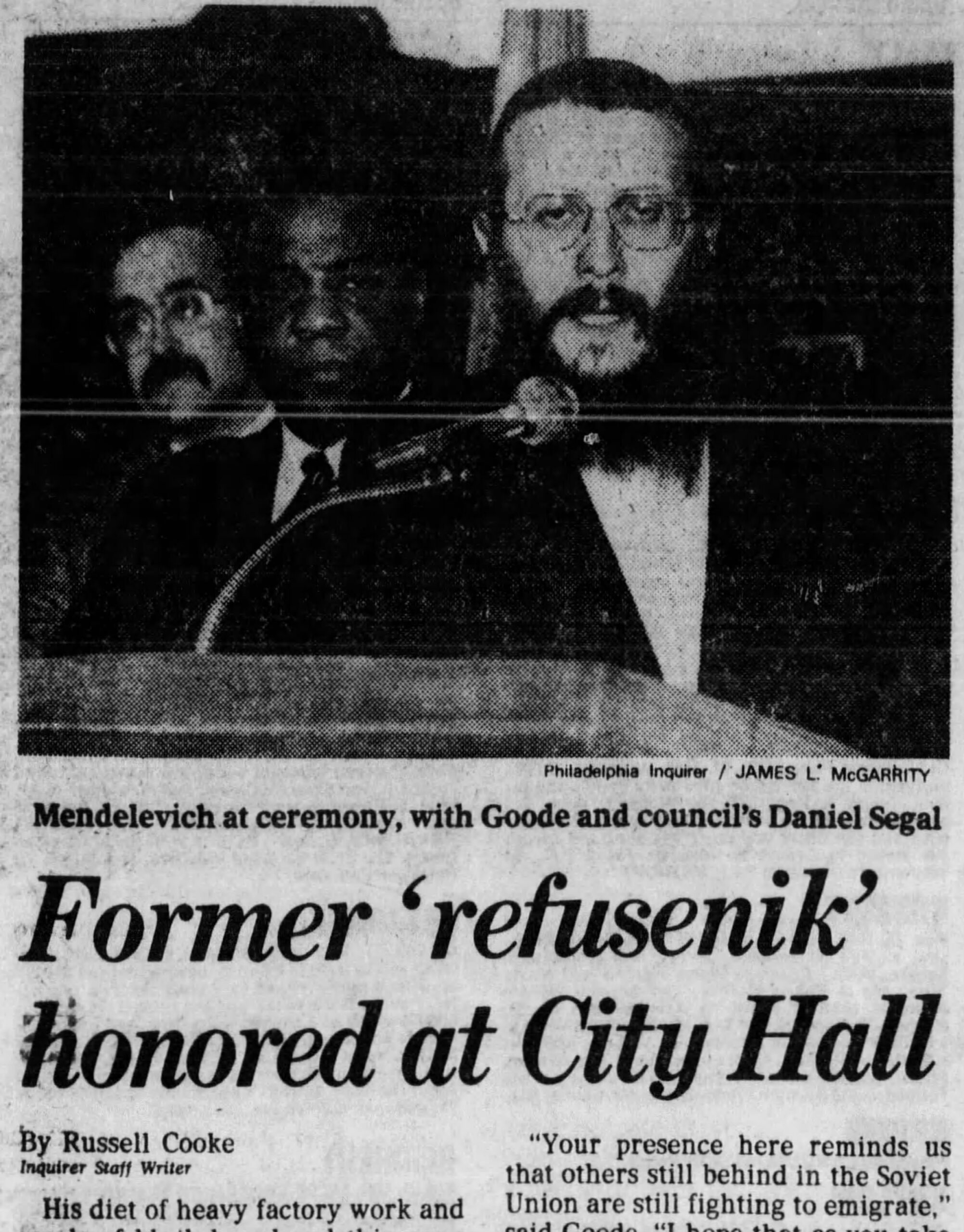

Mr. Jordan became active in Democratic politics after college in the 1960s and served as president of the Jenkintown Borough Council, Democratic state committeeman, and state platform committeeman. As Montgomery County Democratic chair in the 1970s, he told The Inquirer that he disliked gerrymandering and favored giving county executives extensive staff appointment powers.

He enlisted in the Army after law school. “He was absolutely the most congenial person,” his daughter Diana said. “He was kind and caring.”

David Malcolm Jordan was born Jan. 5, 1935. He earned a bachelor’s degree in history at Princeton, was secretary and president of the Class of 1956, and returned to the campus often for reunions and other events.

He married Barbara James in 1960, and they had daughters Diana, Laura, and Sarah, and lived in Jenkintown. His wife died in 2006. He married Jean Missimer Liddell in 2007, and they lived in Wayne and Haverford.

Mr. Jordan enjoyed college basketball games at Penn’s Palestra, especially if Princeton was in town. He went to the Metropolitan Opera House in New York often and collected baseball cards and stamps. He was an avid reader and on the board at the Jenkintown Library.

“I guess I just had a lot of available energy to practice law, write books, and help run Jenkintown,” he told the Princeton Alumni Weekly. “It didn’t seem so hard at the time, though looking back makes me wonder.”

His daughter Diana said: “He never stopped. He was passionate about everything.”

In addition to his wife and daughters, Mr. Jordan is survived by three grandchildren, a sister, and other relatives. A brother died earlier.

A private celebration of his life is to be held later.

Donations in his name may be made to the Jenkintown Library, 460 York Rd., Jenkintown, Pa., 19046.