Gov. Josh Shapiro had a message for data center developers on Tuesday: Come to Pennsylvania, but bring your own energy — or pay up.

During his budget address, Shapiro said his proposal — the Governor’s Responsible Infrastructure Development (GRID) standards — will ensure center operators are “not saddling homeowners with added costs because of their development.”

Data centers, which house the technology to power cloud storage and other computing, have been proliferating across the country and the region due to the increasing demands of generative artificial intelligence, or AI. State and local officials are trying to keep up with the rapid pace of development, proposing new legislation — and updating existing measures — in an attempt to regulate the facilities.

Shapiro’s plan would require data centers to supply their own energy or pay for any new generation they need. It also calls on them to hire and train Pennsylvania workers and comply with “the highest standards of environmental protection,” including in water conservation, Shapiro said.

In exchange, the governor added, data center developers will get “speed and certainty” in the permitting process, as well as applicable tax credits.

The comments from Shapiro, a Democrat who has consistently encouraged data center development, come amid a flurry of legislative and executive action, as elected officials promise to keep Pennsylvania and New Jersey consumers from bearing the costs of these power-hungry facilities.

Data centers, the electric grid, and governors’ proposals

Locally, proposals for large AI data centers have faced opposition from East Vincent Township, Chester County to Vineland, Cumberland County.

Many experts have attempted to quantify the impact of these centers on Americans’ energy bills. In one analysis, Bloomberg News found that the monthly electric bills of customers who lived near significant data center activity had increased 267% in the past five years.

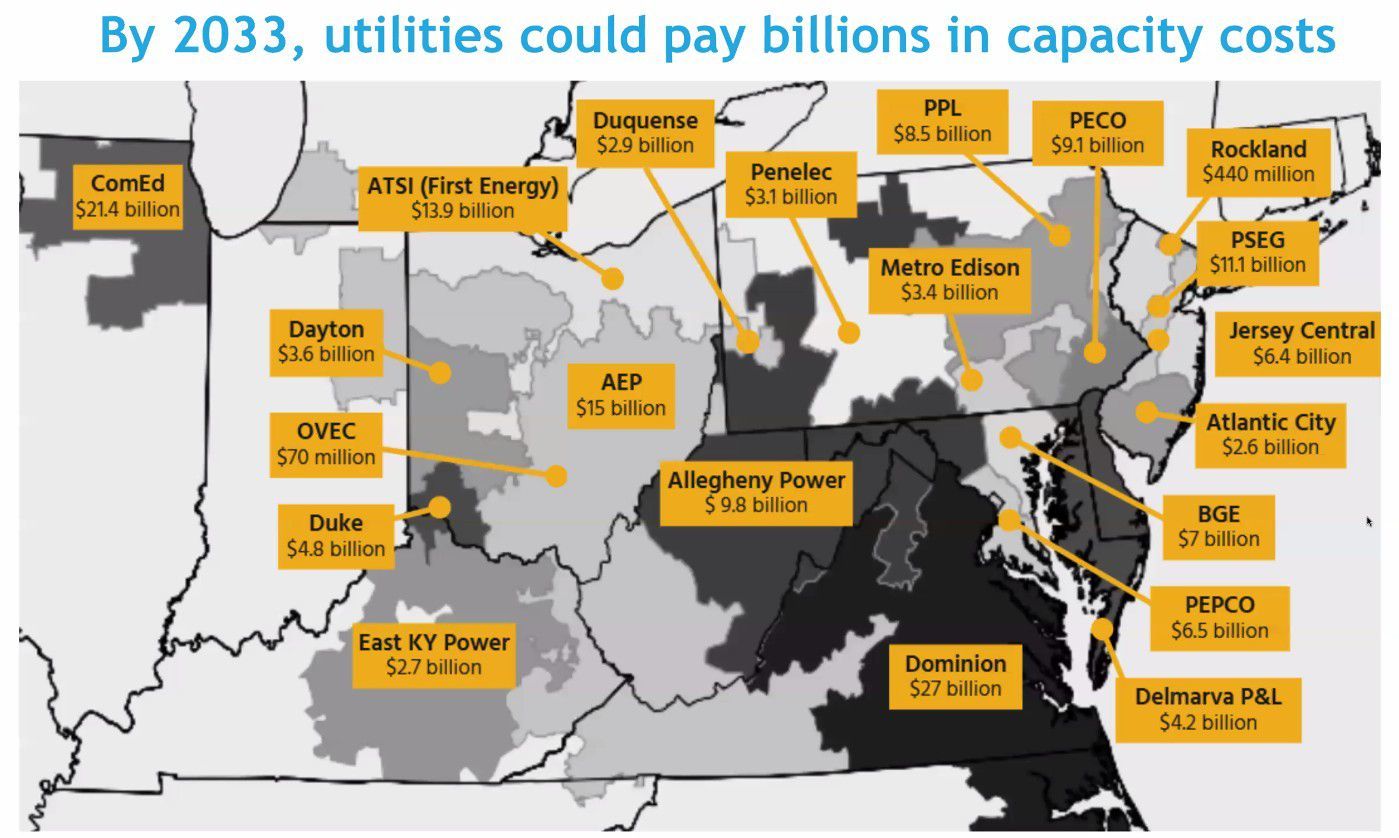

At the same time, some governors, including Shapiro, have criticized and sued PJM, the Montgomery County-based electric grid operator, over its annual capacity auction, which influences how much customers pay.

On Tuesday, Shapiro reiterated calls for PJM to speed up new power-generation projects and extend a price cap.

Separate from GRID, Shapiro also said electric companies, including Peco, should increase transparency around pricing and “rein in costs” for consumers, including low-income and vulnerable Pennsylvanians.

“These steps will save consumers money immediately,” Shapiro said. He announced an energy-affordability watchdog to monitor utility-rate requests and take legal action if necessary to prevent companies from “jacking up their rates and costing you more.”

In New Jersey, new Gov. Mikie Sherrill made energy affordability a central tenet of her campaign. At her inauguration last month, she declared “a state of emergency on utility costs,” following through on a promise she had made in stump speeches and TV ads.

Through several executive orders, she froze utility rates and expanded programs to spur new power generation in the state. She also ordered electric utilities to report energy requests from data centers.

“This is just the beginning,” Sherrill said in her inaugural remarks. “We are going to take on the affordability crisis, and we are going to shake up the status quo.”

In Pennsylvania, ‘Data Center Consumer Protection Bill’ advances

Meanwhile in Harrisburg and Trenton, some lawmakers have other ideas about how to keep residents from subsidizing data centers.

As of Tuesday, nearly 30 bills in the Pennsylvania and New Jersey legislatures mentioned data centers, according to online records. Many of those bills aren’t directly related to residents’ electric bills, and instead address the facilities’ energy sources, water usage, environmental impacts, and general regulation.

Others attempt to tackle rising consumer costs.

On Monday, the Pennsylvania House Energy Committee advanced a measure referred to as the “Data Center Consumer Protection Bill.” Lawmakers say it would keep residents’ bills down by creating a regulatory framework for data centers and requiring their operators to contribute to utility assistance funds for low-income Pennsylvanians.

“Today’s vote brings us one step closer to protecting ratepayers,” Robert Matzie, the Beaver County Democrat who introduced the bill, said in a statement. “Data centers can bring jobs and expand the local tax base, but if unchecked, they can drive up utility costs. Electric bills are already too high.”

The state House Energy Committee also heard testimony Monday on a bill that would allow the state to create a “model ordinance” for local municipalities to regulate data centers, and another that would require centers to report their annual energy and water usage.

The bills were introduced by State Reps. Kyle Donahue and Kyle Mullins, both Democrats from the Scranton area, which has become a hot spot for data center development.

“There is a real concern and a sense of overwhelm among the people we represent,” Mullins said at the hearing. “The people of Pennsylvania have serious concerns about data center energy usage and water usage, especially as they see utility bills continue to rise rapidly.”

Dan Diorio, vice president of state policy for the Data Center Coalition, said he worried the bills would discourage operators from building in Pennsylvania. He said they are already incentivized to reduce energy costs, which are estimated to make up anywhere from 40% to 80% of a data center’s total operating costs.

“Data center companies strive to maximize energy efficiency to keep their costs low,” Diorio said.

Rep. Elizabeth Fiedler, the Philadelphia Democrat who chairs the energy committee, closed Monday’s hearing by reminding members of one of its main objectives: to “keep down the energy bills that are skyrocketing for people back home.”

A South Jersey lawmaker says his bill could help consumers

The pain of skyrocketing utility bills has been felt acutely in New Jersey, which unlike Pennsylvania uses more energy than it produces.

Between 2024 and 2025, New Jersey residents’ electric bills rose more than 13% on average, the fifth steepest increase in the U.S., according to federal data analyzed by the business magazine Kiplinger. Pennsylvanians saw a nearly 10% increase during the same period, according to the data.

Prices are expected to keep rising in the coming years as more data centers are constructed.

A bill sponsored by New Jersey State Assembly member David Bailey Jr., a Democrat from Salem County, attempts to prevent future price hikes.

The legislation would require data center developers to have “skin in the game,” as Bailey described it in a recent interview, and sign a contract to purchase at least 85% of the electric service they request for 10 years. He said it would also provide incentives for data centers to supply their own energy generation.

“I don’t want to come off as an anti-data center person,” said Bailey, who represents parts of Gloucester, Salem, and Cumberland Counties. “This is a very positive thing. We’re just saying we don’t want these big companies to come in and pass this [cost] on to our mom and pops, our neighbors, and our everyday ratepayers.”

Bailey said he was disappointed that his bill was pocket-vetoed by former Gov. Phil Murphy last month. Now, it has to restart the legislative process. But Bailey said he expects it to eventually pass with bipartisan support.

“No matter your party affiliation you understand the affordability issue,” Bailey said. “You understand your electric bill” — and how much it has risen recently.